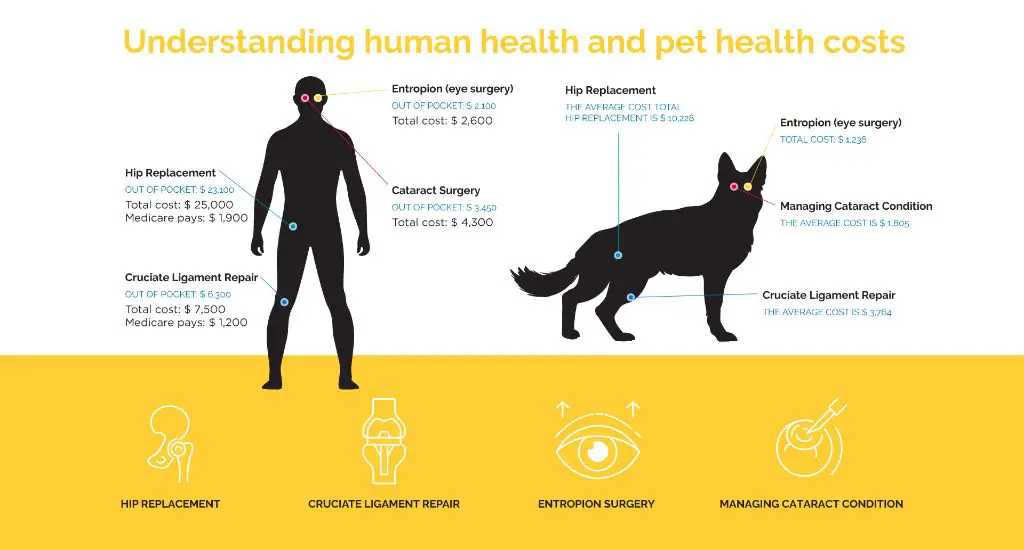

Cataracts are a common eye condition where the lens becomes progressively opaque, causing blurry vision, difficulty seeing at night, sensitivity to light and glare, and double vision in one eye. As cataracts worsen, they can significantly impact daily activities. Cataract surgery is the only treatment option to remove the clouded natural lens and replace it with an artificial intraocular lens to restore vision.

The purpose of this article is to provide an overview of the costs associated with cataract surgery for those with Medicare insurance. We will look at what portions of the surgery Medicare covers, additional out-of-pocket expenses, ways to reduce costs, and other factors that can impact the total price of cataract surgery.

Medicare Coverage for Cataract Surgery

Original Medicare covers cataract surgery under Part B, which covers outpatient services and medical equipment (https://www.medicare.gov/coverage/eyeglasses-contact-lenses). Part B helps pay for doctor services as well as the surgical procedure itself. This includes the pre-operative exam, the operation to remove the cataract, and the insertion of an artificial lens.

Part A, which covers inpatient hospital care, generally does not apply to cataract surgery. Cataract removal is usually done as an outpatient procedure and does not require an overnight hospital stay. Therefore, Part B covers most of the costs associated with cataract surgery.

In summary, original Medicare provides coverage for cataract surgery through Part B, while Part A does not typically come into play. This is because cataract surgery is an outpatient procedure covered under Part B for doctor services and medical equipment.

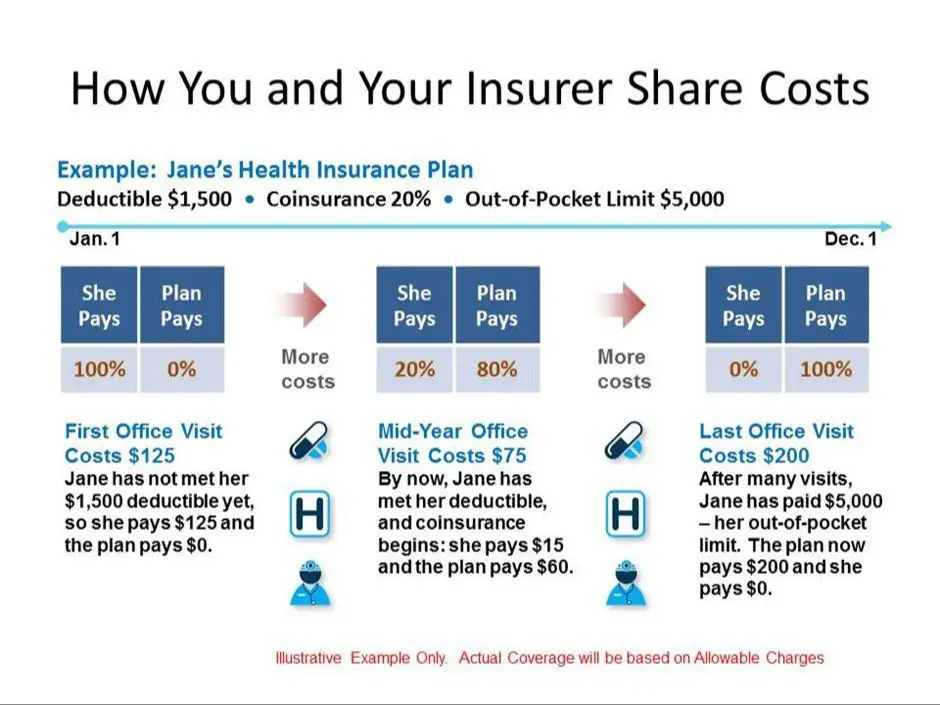

Medicare Part B Deductible

Before Medicare Part B begins covering medical services, beneficiaries must first pay an annual deductible. For 2023, the standard Medicare Part B deductible is $226 per year, according to the Centers for Medicare & Medicaid Services (1). This represents a $7 decrease from the 2022 Part B deductible amount of $233 (2).

The standard Medicare Part B deductible amount changes each year to account for healthcare inflation costs. Beneficiaries must pay all costs for Part B-covered medical services up to the deductible amount before Medicare coverage kicks in.

Medicare Co-Insurance

Original Medicare Part B covers 80% of the Medicare-approved amount for cataract surgery. The beneficiary is responsible for paying the remaining 20% coinsurance.

This 20% coinsurance applies to the physician fees, facility fees and cost of the artificial lens implanted during cataract surgery. There is no yearly limit on the coinsurance amount a beneficiary must pay under Part B.

According to the Centers for Medicare & Medicaid Services, the national average coinsurance amount for cataract surgery in 2022 was $597. However, this amount can vary depending on the state you live in and the costs charged by the surgical facility and surgeon.

It’s important for patients to understand their responsibility for this 20% coinsurance when budgeting for cataract surgery. There are options like Medigap plans that can help cover all or part of the coinsurance costs.

Overall, the 20% coinsurance is a standard cost-sharing amount that applies to all Part B-covered medical services like cataract surgery. Knowing the average coinsurance costs in your area can help you estimate what your out-of-pocket expenses may be.

Sources:

https://www.medicare.gov/coverage/cataract-surgery

https://www.medicare.gov/procedure-price-lookup/cost-data/national-averages

Additional Out-of-Pocket Costs

In addition to the Part B deductible and 20% coinsurance, there may be other out-of-pocket costs associated with cataract surgery that Medicare beneficiaries should be aware of:

Anesthesia – Medicare covers anesthesia services for cataract surgery, but the patient will be responsible for the Part B deductible and 20% coinsurance for these services. According to Medicare data, the average cost for anesthesia for cataract surgery is around $241.

Facility fees – The facility where the surgery is performed may charge additional fees for the use of the operating room, medical supplies, nursing services, etc. These fees are covered by Medicare Part B, but the patient must pay their portion of the 20% coinsurance.One source estimates these fees at $300-500 per eye.

Surgeon fees – The surgeon who performs the cataract operation will bill separately from the facility fees. Medicare covers this, subject to the Part B deductible and coinsurance. Surgeon fees often run $1200-$1500 per eye.

Corrective lens implants – Original Medicare covers standard monofocal lens implants, but patients may choose advanced implants that correct astigmatism or presbyopia. These upgraded lenses cost $1500-$3500 per eye out-of-pocket.

Post-surgery medications – Medications needed after surgery like antibiotic and anti-inflammatory eye drops are not covered by Medicare Part B. These typically cost $50-$100 for a course of treatment per eye.

Medigap Supplemental Insurance

Medigap plans can help cover coinsurance, copayments, and deductibles associated with Medicare Part B coverage for cataract surgery. Medigap is supplemental insurance sold by private insurance companies that helps fill gaps in Medicare coverage. If you have Original Medicare and get a Medigap policy, it will pay for some or all of the 20% coinsurance you would otherwise owe for Part B-covered services like outpatient cataract surgery.

For example, Medigap Plan G covers 100% of the Medicare Part B coinsurance, except for the annual $233 Part B deductible in 2023. So with Plan G, your out-of-pocket costs would be limited to the Part B deductible. Some other Medigap plans like Plan C and Plan F may cover the Part B deductible as well, but they are only available to those who were eligible for Medicare before 2020.

To summarize, purchasing a Medigap plan can substantially reduce your out-of-pocket expenses for cataract surgery covered under Medicare Part B. Just make sure to select a plan that provides adequate coverage for the coinsurance and deductibles you would otherwise have to pay.

Average Total Costs

With original Medicare (Parts A and B), the average out-of-pocket cost for cataract surgery is around $2,600 per eye, according to NerdWallet. This includes the Part B deductible and 20% coinsurance you’re responsible for.

Here is a breakdown of the average costs according to NerdWallet’s analysis:

- Medicare approved amount: $2,664

- Medicare pays: $2,131 (80% of approved amount)

- Part B deductible: $233 (in 2023)

- 20% coinsurance: $300

- Total out-of-pocket: $533

So with both the Part B deductible and coinsurance, the total average out-of-pocket cost with original Medicare is about $2,600 for cataract surgery on both eyes (Source).

Ways to Reduce Costs

There are several ways cataract surgery patients can reduce their out-of-pocket costs for the procedure.

One option is to find low-cost providers in your area. Many hospitals and surgery centers offer discounts or sliding-scale fees for uninsured or underinsured patients. Ask your doctor for provider recommendations or search online for affordable cataract surgery options nearby.

Purchasing additional insurance like a Medigap policy can also lower your costs. Medigap plans cover Medicare deductibles, copays and coinsurance, reducing the amount you pay out of pocket. Plans that cover foreign travel emergency care may also cover cataract surgery abroad at significant savings.

You may also qualify for financial assistance through Medicare Savings Programs which help pay Medicare premiums, deductibles and copays based on income. Charitable organizations like the Lions Club also provide means-tested assistance for cataract surgery costs.

Other ways to save include using flexible spending accounts, health savings accounts, asking about cash discounts, and negotiating costs ahead of surgery. With some legwork and planning, there are ways to significantly lower cataract surgery expenses covered by Medicare.

Other Factors Affecting Cost

The cost for cataract surgery can vary significantly depending on the complexity of the procedure and geographic location where the surgery is performed. More complex cataract cases often incur higher fees from the surgeon and facility. For example, patients with pre-existing conditions like glaucoma or diabetic retinopathy may require specialized lenses or additional steps during surgery, which can increase costs. The experience and reputation of the surgeon can also impact pricing.

Location is another major cost factor. Surgery fees are typically highest in metropolitan areas and lowest in rural areas. The cost differential can be thousands of dollars between a major city and a small town, even within the same state. Patients in higher cost areas can reduce expenses by exploring having surgery performed at an ambulatory surgery center instead of a hospital facility. Healthcare pricing often has little correlation to quality of care or outcomes.

Conclusion

In summary, here are the key points on the costs of cataract surgery with Medicare coverage:

- Medicare Part B covers 80% of the Medicare-approved amount for cataract surgery, after you pay the Part B deductible.

- You will be responsible for 20% coinsurance on the Medicare-approved amount.

- Additional out-of-pocket costs may include the surgeon fee, facility fee, anesthesia, and eye tests.

- Medigap or supplemental insurance can help cover coinsurance costs.

- The national average cost for cataract surgery is around $3,500 per eye, but costs can vary widely.

- Shopping around for the best price and using in-network providers can help reduce your out-of-pocket costs.

Understanding the expenses involved allows you to plan your budget accordingly for cataract surgery with Medicare. Always check with your providers to get personalized cost estimates based on your specific medical needs and insurance coverage.